The last couple posts we’ve been talking about money mindset and how it’s important and how it plays a big factor in how our money plays out.

Last week we talked about identity and how our identity needs to be in congruence with our actions. Otherwise, we will self-sabotage.

Previously, we talked about scripts and stories about how stories come from society and how they come from our family, and how they come from our own head, and how those are repeated.

Humans are Emotional

Well, today I want to talk about money scripts. Money scripts. Money scripts are the unconscious beliefs that we have regarding money.

There’s been a lot of advancement in the last couple years in a study called behavioral finance, so the genesis of financial planning is the idea how.

All these different domains of money savings, debt investing, insurance, estate planning, et cetera, et cetera, how they all play together to help you get from essentially at a basic level where you are today to where you want to be in the future. That’s what financial planning is about out, and there’s a lot of academia involved with financial planning, theories, textbooks.

And concrete, rational conclusions of the way things should be.

But here’s the problem. The problem is we’re dealing with humans and humans are not always rational. Humans are not always logical. Humans don’t always do the best things for themselves. Humans are emotional beings. It’s our emotions that drive more of our decisions than logic and rational.

We are emotional beings. God put in us a series of emotions, and it’s those emotions that drive a lot of our decisions, and frankly, it’s things that we’re not even conscious about. We’re not even aware of what’s happening.

And so, there’s this other side of finance that has been coming about for the last 15, 20 years, and it’s really the behavioral side of finance. It focuses on the behavioral aspects of finance, not just the logic and the textbook answer.

And as we’ve been talking about behavior, Drives results, beliefs, drive actions. That’s behavior which drive outcomes. And so, we talked about how beliefs are really where all change starts.

In coaching and planning and advising people, I’ve seen this play on a handful of times, money scripts and it, and it ranges the spectrum.

I remember a couple years ago, I had a client, 20 17, 20 18 type timeframes, and every time we met, and we would talk about kind of where they were today, they always got upset.

They often cried and got emotional over it.

And my suspicion was that it was some sort of script. I don’t like where I’m at. I’m ashamed where I’m at. I wish I wasn’t here. Bad things happened to me in my life that have caused financial hardships. Choices. I’ve made decisions, I’ve things what ifs, all the things that people generally go through when we’re dealing with money in general.

But for that person, it was very, very emotional, and often brought about tears and regret and sadness. My belief is because it was a script that was going on in there, in their minds.

Brad and Ted Klontz have been pioneers in this area from an academia perspective, and they’ve really described four different scripts that people play in their minds. And it’s not like you’re just one at one point and another, another, somebody else is another, another point. Throughout a day or throughout a, a lifetime or throughout an even a meeting with a financial advisor, we can go through four different, all four of these scripts regularly.

And so, I want to take some time here today to unpack these a little bit, give you some understanding of what they are, and maybe to see if we can recognize them in our own lives.

Four Different Scripts – Money Avoidance

These four scripts are, they describe them again. Ted and Brad Klontz described these four as money avoidance, money worship, money status, and money vigilance.

So, I want to take some time to unpack all four of these.

The first one is money avoidance. That’s a person who sees money as something associated with greed or evil bad. The proverbial money is the root of all evil, which is not really what the Bible says. The Bible says the love of money is the root of all evil.

The person who has the money avoidance script feels that their undeserving of money, and we talked a little bit about that in our last episode of identity. They feel guilty for wanting money. And so, they generally just prefer to avoid it, to not even think about it. Now, the problem with that obviously, is that money is tied into just about every aspect of our lives and our society.

So, the person who doesn’t want to think about it and tries to avoid it is going to struggle when it comes to money.

Four Different Scripts – Money Worship

The second one, the second money script that Brad and Ted Klontz talk about. Is that of money worship. So, a person who worships money, they associate money or wealth with freedom and happiness.

It’s the type of person who generally gets fulfillment out of spending it. They believe that money will solve all their problems, all their problems in their life can be traced back to money. And if they just had more money, then that will solve all their problems. There’s never enough money.

Often, they’re associated with overspending. They tend to be riskier. They are more prone to gambling maybe than some of the other scripts. Generally, workaholics fit into this bucket. The people who just grind away for more at the expense of other things because they worship money.

It is the center of their lives.

Four Different Scripts – Money Status

The third script that Brad and Ted Klontz talk about is money status. Money status. So, this is a person who views that their net worth or their income, Derives their self-worth. They derive their self-worth from their income. I’m a worthy person because I have a lot of money, or I’m a worthy person because I make a lot of money.

They often are prone to lying about money to impress others, how much they make, how much they have. They believe that the amount of money or income that they have. Equates their social standard, so they’ll overspend to keep a certain because status shows wealth, which then shows self-worth.

Well, let me tell you your money has no bearing on your self-worth.

You are worthy because you’re a human. You’re a worthy because God made you. You are worthy because you are a living soul regardless of where you are financially.

Four Different Scripts – Money Vigilance

The fourth group that Brad and Ted’s Klontz talked about is money vigilance, and so this is the type of person who views money’s to be saved and not to be spent.

They’re the proverbial penny pincher or, or the thrifty type of person. They associate handouts from government or social or friends or family, whatever it might be as evil and bad. They often get anxious about their money. They associate working for money as a noble endeavor.

Now the reality is, like I said, we can be all four of those at any given moment.

You can go from money status to money, vigilance money worship to money avoidance, all depending on the situation of our lives.

But much like personality assessments, we kind of lean or bend towards certain of those. And if you’ve ever done some Personality assessments, maybe Meyers-Briggs or the DISC assessment or the Enneagram assessments, things like that.

They’re helpful to some degree in that. They give you some perspective as to how you think, how you behave, how you’re wired, if you will. They’re not always a hundred percent accurate.

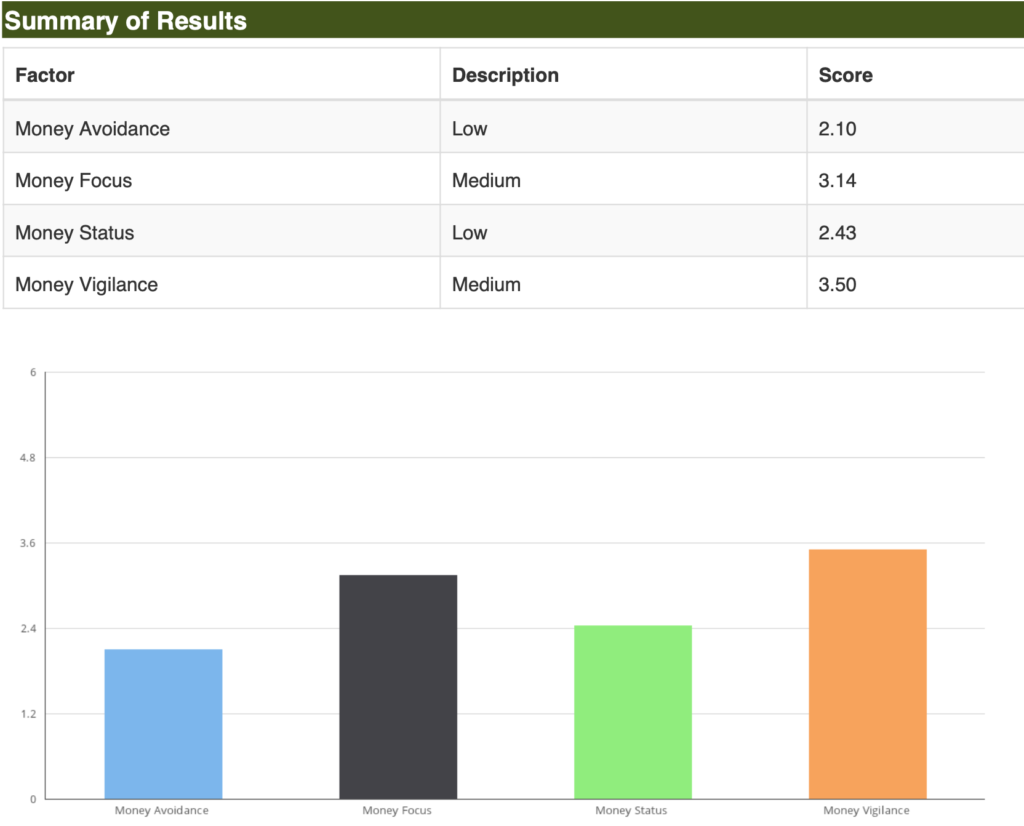

I recently took a Brad and Ted Klontz have an assessment if you will answer, ask you to answer 30 questions and it kind of gives you back a score. And I did that, and it was kind of enlightening for me. Just like all these other personality tests, if you will.

My Money Script Assessment Results

My highest area, so they kind of rank you in zero to five or something like that. The higher the number, the more prone you are to that area. The lower the number, the, the least.

My highest score was in money vigilance. I. Which is kind of makes sense because I’m a financial planner. I think money should be saved. I’m kind of frugal. I don’t like handouts. You know I think working for money is a noble cause. So that, that kind of makes sense.

My least area would be money avoidance, which also would make sense. I talk about money, you know, every day of my life essentially. So. It’s not something I viewed to be avoided, so that, that would make sense.

Generally, though of those four I was, I was kind of even right. There was not a big standard deviation between, between any of those. And so last episode, we talked about identity.

This might be a tool that might be beneficial for you to kind of hack into your identity a little bit to see how you really think about money.

In the description below, I’m going to put a link where you can get to Mr. Klontz’s money script test.

Now, I will caution you.

One, I have no affiliation with him. I’ve never met him personally. I’ve read a lot of his, his work and has seen it in various textbook stuff. He does work in the financial services arena.

And it has an association with data points. So, you might get some emails from him on products or services you know, that him and his company offer.

But I think you can just download it. You don’t necessarily have to put a valid email address if you don’t want to. If you can, that’s fine too. Nothing wrong with either way.

Micro Action – Take the Assessment

But I want you to take, five, 10 minutes or so and go take that assessment. Go through the questions and see your results and take some time to read it, and that might give you some insight as to your money script, which again might give you some insight into your money mindset, because that’s what we’ve been talking about the last couple posts.

https://www.bradklontz.com/moneyscriptstest

How money mindset, your beliefs drive your actions, which drive the outcomes, which provide evidence, which then reinforces or contradicts our beliefs. So, all the time that we’re spending on this, eventually we will get to tactics and strategies and techniques and all kinds of various things in the financial realm.

But if your money mindset is not sound, those techniques and strategies and tactics are going to only take you so far. You’re still going to be limited, which is why we’re trying to take the time in the beginning here to lay a good foundation.

So that’s your action for the week, your micro action to help you on your financial journey.

Take that money assessment, get the results, review them, take some time to reflect on it. And the next post, I’ll share a frame of reference that’s really helped me personally with my money mindset over the last decade.

So, until next time, I hope you have a great day.