Today I want to talk about a couple of advanced budgeting tactics or techniques. While basic budgeting is great for getting started. It’s not fully functional in terms of application or usability.

In today’s post, I want to talk about distributed budgeting, tracking of expenses, making the adjustments when things happen, and some techniques and tactics to help you with those that have an irregular income.

We talked about in the basic budgeting Episode about the three steps of creating a budget or a spending plan.

Step number one was to forecast your income. Step number two was to allocate for expenses. Step number three was to allocate until zero base, meaning that income minus expenses equals zero every dollar had a job and had a starting position in the plan. But there’s really a fourth step and the fourth step are to distribute the budget.

Distribute the Budget

What is distribute the budget?

Distributing the budget adds a new dynamic to the budget while basic budgeting looks at the whole month in general That’s not how most people get paid. Most people get paid either weekly or biweekly or maybe twice a month, like the first and the 15th. If you’re one of those people who get paid one time a month, obviously that makes it easier.

Next week we’ll talk about the non-budgeting budget system where you can simulate the reality of getting paid one time a month. But for now, we’re going to talk about distributing the budget. It’s essentially subdividing how much each paycheck and expense You’re going to allocate to one specific time.

This primarily deals with the timing or the “when” of the budget. The basic in budget deals with who and how much. The distributing aspect adds when to it. Throughout the month you must constantly balance this money that’s coming in and that money that’s going out. We often refer to that as cashflow.

How this looks practically is that you simply take the amount of your income, and you break it up into chunks as to when it’s going to come in. And you do the same thing for expenses. You take the amount that you’re going to spend, but you give it a timing element. It could come out of one paycheck, or it could, you might have to save up, and it could come out of multiple.

Let’s look at a couple of notional examples of how this works practically.

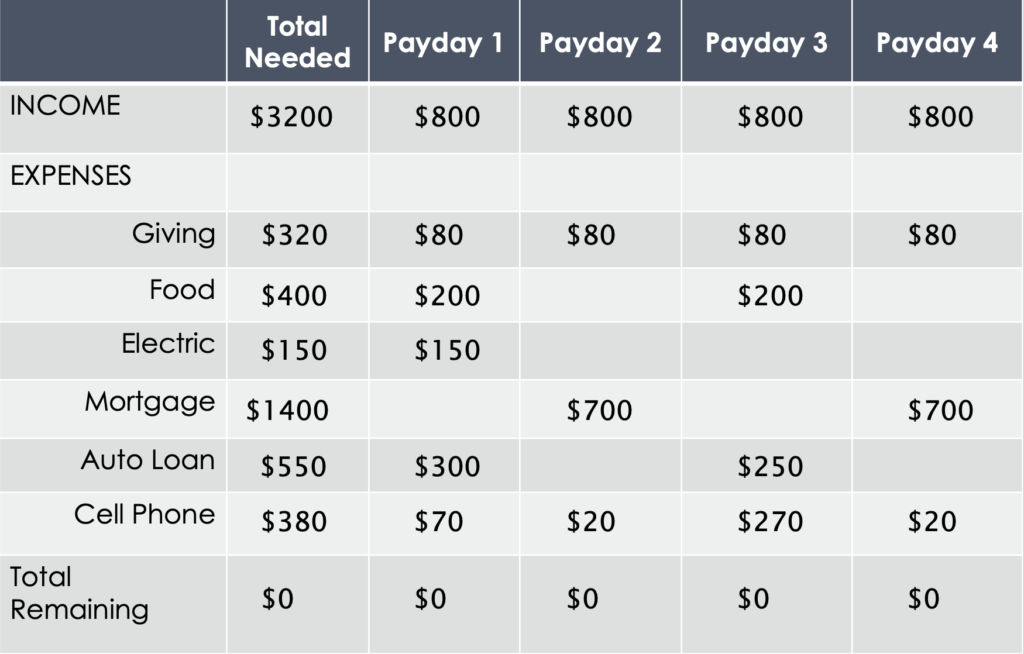

This is a notional example of how to make a distributed budget. This individual or couple makes 3, 200 a month. But again, the distributed budget has to do with the timing of it. In this case, this individual or couple gets paid every week. In this month that they’re doing their budget for, there are four months.

We simply took the amount that they have, and we distributed it. Based upon each paycheck. For each paycheck, they get 800 per paycheck, totaling 3, 200 for the month. We basically divided it up and we distributed it over the month of when they get there. Paychecks. Okay. They’re going to do some giving first.

This couple is going to give 320 for the month. Well, again, distributed budget deals with the timing of it. When are they going to give it? They’re going to give 80 from each paycheck. And we can see for this paycheck, paycheck one, there’s 800 coming in. We have allocated 80 of those paychecks. And we have 720 left to go.

Okay. The next thing is on their basic budget, they allocated 400 for food. Now we’re going to say, okay, when are we going to spend that? Well, they’re going to take 200 from their first paycheck and 200 from their third paycheck to distribute that 400 across the month. And we can see that the, the balances now for those individual paychecks go down.

Okay, their electric bill. Their electric bill is going to be due maybe around the 7th of the month. If their bill is due on the 7th of the month, they can’t use their paychecks that come later in the month. They must use their first paycheck to allocate towards their electric bill. And again, we see that the money from this specific paycheck goes down.

Okay. Their mortgage, their mortgage is 1, 400. Nowhere do they make enough money from one paycheck to cover the entire mortgage. What they must do is they have to allocate certain portions of money from the two paychecks in this case, 700 from paycheck number two and 700 from paycheck four that they have the money to pay the mortgage that is due on the first of the month.

And again, now the balances. Come down respectively. Okay, their auto loan. Let’s say their auto loan is maybe due the 25th of the month. They’re going to take 300, allocate 300 from paycheck one. They’re just going to leave it in the checking account and then 250 from paycheck three, again, just leaving the checking account.

And then they’re going to pay the bill either by., making the payment online, setting a bill pay, writing a check, debit card.

Again, the balances come down. Now they have their cell phone, their cell phone was 380. Maybe it’s due towards the end of the month.

They’re going to allocate 70 from paycheck one, 20 from paycheck two, 270 from three and 20 from four to have then have the money to pay the cell phone bill. And again, the balances. Come down accordingly. We can see now that we have distributed all the months. This part here was their basic budget for the month, but now they have a distributed budget.

They know exactly when they’re going to get paid. When they get paid. For paycheck one, they know exactly what they’re going to do with it. They’re going to give 80, they’re going to take out 200 for groceries, they’re going to pay their electric bill, they’re going to leave in their account 300 for auto loan, and 70 for the cell phone.

And they have a plan for each paycheck for the month. Again, this distributes it based upon the timing of it.

You can find these forms at truewealth.show on the resources page. Click on the distributed budgeting forms.

This helps you know, exactly when you’re going to get paid and exactly what you’re going to do with it. This will give you complete control. Where the money’s coming from, where it’s going and when it’s going there.

And that’s how we distribute the budget. Ideally, everything is balances down. And when it does, you have the perfect starting plan for every dollar for the month. How much it’s going. To whom and when it’s going to go there. Now you just must simply follow the plan.

Tracking Monthly Expenses

Which then brings us to tracking. Tracking is the idea of aligning monies received or spent to a budget category. It helps you stay on track how much you’ve spent. There’s a lot of different ways this can be done. I have a friend who lives in Omaha. Him and his wife have a spreadsheet that they’ve had probably for 25 years if they still do it.

I’m sure they did. I know they did it for at least for their first 20 years of their marriage. And they have a spreadsheet of every dollar they ever spent as a couple. They basically would bring home their receipts and every couple of days one of them would sit down and add the expense to their spreadsheet for every month, which would total up to every year.

A lot of people use apps to do this. Next week we’ll address a couple of those apps, but for now I want to show you in the spreadsheets that can be found at true wealth dot show forward slash resources of how to capture and track your expenses throughout the month.

This becomes a great tool for tracking your actual spent, which again carries back over to here where you can get some feedback as to how much you have remaining.

And, or if you’re going to go over or under, and then you can use that feedback for the next month.

Adjusting the Budget

Now this brings us to adjusting as we started your basic budget or even now your distributed budget is a starting plan, but it doesn’t necessarily mean that’s how everything’s going to go. If you think about budgeting every month like a car journey, where you’re starting and where you’re trying to get to and the turns in the route along the way.

But sometimes there’s some unforeseen things at events that occur. You must make a detour. You might have to get off the interstate. You might have to make some U turns. And what happens when you do that if you’re following your GPS? Every time you get off the initial track, your GPS recalculates and helps you figure out a new path.

But that GPS must know where you’re at. And that’s why tracking is important. Because if where you’re at, you can begin to start to adjust. If you remember… The whole idea of these budgets is that they’re zero based, which means if you overspend in an area, you’re putting yourself at risk of either over drafting your account or possibly bouncing a check if you still write some checks.

Most people don’t, but occasionally some people do.

If you’ve overspent in one category, that means you’re going to have to make some adjustments where something else is going to have to go down. Or conversely, where you thought something would cost this much, but it costs less. Well, now that you have an extra amount that you can reallocate to something else.

If one category goes up, something else must go down.

Irregular Income

One last tactic or technique that I want to address in this episode is that of irregular income. There are a handful of people who have irregular income due to maybe owning a business. being in sales, getting bonuses, and thus it makes it a little bit harder to forecast your income. Again, next week, we’ll talk about the non-budgeting budgeting system.

In the future, I’ll show you how business owners can use a framework to systematize their income to make it more stable and consistent.

But for now, I want to give you a couple of simple ideas of how you can go about. Systematizing your budget if you have irregular income.

Let’s assume for example, that you maybe have a base plus commission.

You get a base of a certain amount of dollar a month and you have extra income that fluctuates throughout the month. The idea is that you. Budget off your known income coming in first and then have a second prioritized plan for any additional monies that might come in.

Let’s say for example, you have a base of maybe 2, 000 we know that that money’s coming in every month.

You’re going to get that 2, 000 and if you look back at the last six months of all you. income from your commissions, you see that it has a, it goes up and down and it has a variety, but your lowest month was 2, 500.

We have 2, 000 and 2, 500. We put those together and we have now, 4, 500 we do is we set up our regular budget basic budget and distributed budget off that 4, 500 because we have a high level of confidence that that money’s going to come in,

which then says, okay, what do you do with the rest of the money? Well, here we have a prioritized list. We do is we make another list of all the potential things that we want to spend money on.

Maybe do some extra giving. We put giving 10 percent maybe we’ll do a little bit of savings. 500. Maybe we’re saving up for some new furniture. Maybe we want to buy a new, more clothing. You list all those things out and you make the list longer than, the money’s going to come in. You have a what you want to spend it on and a dollar amount with it.

And then you reprioritize the list. If you can only do one thing on the list because you only get a little bit extra money, what’s the one thing? What’s the second thing you want to do? And you reprioritize the list now you have a prioritized list from one to n things with the most pressing and important being at the top.

Essentially kind of giving you two budgets. Then as money comes in, you first execute your normal budget. And then if money comes in above that 4, 500, you use the prioritize spending list to then allocate money towards those different things until the money runs out.

Conversely, another way to handle irregular income, a technique or tactic, if you will, is to utilize a hill and valley account, which kind of acts like some floats. When you have months where you have excess money coming in, you put money into that account. That’s the hill part. And then when you have down months, you make less than what your kind of normally need.

You pull money from that account. That’s the valley aspect.

What they could do here is they could baseline their expenses, their budget, if you will, of a certain dollar amount, let’s say 4, 500 in this example.

And then what we have is we have what’s called a Hill and Valley account, a separate account. And the idea is in some months, when we have more than we need, here, for example, what we do is we would put that money into that excess, the things above the baseline that we’re spending, we would put the money in there and then in the down months, like here and here, for example, we would basically pull the money out and.

Bring us up to our baseline there. Again, when we have excess months, money would go in other months, money would come out money would go in, et cetera, et cetera.

And it becomes a hill and valley. What this, the idea is that this here acts as a float, this account and over time might get big or small or whatever, but you normalize your, you have a baseline for your Expenses and use that account to augment the, you take out the hills and the valleys to flatten it out.

That’s the idea of a hill and valley account.

Today we talked about some advanced budgeting techniques. We talked about distributing a budget. We talked about tracking, we talked about adjusting, and we talked about some techniques to deal with irregular income.

Micro Action

Your micro action for the week, start doing a distributed budget. And track your expenses.

Erica and I did a distributed budget for well over 10 years before we moved on to. Utilization of some applications. Our kids can kind of remember the idea that on our refrigerator for many, many years, we would have that distributed budgeting form one, very similar to what I have on true out that show on the resources page.

And we would put it on the refrigerator with a magnet. And it helped us be conscious of what we’re doing with our money throughout the month.

Next week we’ll talk about a couple of other tactics and techniques and technology that you can utilize with budgeting or having a spending plan.

I hope this helps you on your financial journey. If you have any questions or comments, you can leave them down below or you can send me an email to mike@truewealth.show.

I’ll try to respond to every email I get there.

And until next time, I hope you have a great day.