Today I want to provide some information or insight. to small business owners or those that are self-employed and maybe give you some tips on how to better manage your money.

Over the last couple of weeks, we’ve been talking about money management for individuals. We talked about the basic budgeting. We talked about advanced budgeting and distributed budgeting. We talked about the non-budgeting budget system. We talked about how to budget for big projects or big events like Christmas.

But today I want to talk specifically about being self-employed and to business owners.

For many business owners the idea of being self-employed is a dream the idea of being able to do what you want When you want it, where you want it, with whom you want it is the ideal freedom for many people.

But to facilitate that, you must have proper money management. It’s critical to remaining in business. Obviously, you want to have it on your personal side, but you also need it on the business side as well. So that’s what we’re going to talk about today. The idea of money management for small business owners.

When someone launches their business, what a lot of people do is they just start using their personal checking account for everything. I mean, essentially that’s how they’ve done it to this point. They just continue when they worked for a W2 employer, basically their paycheck would come into their account and they would buy groceries, pay their bills, et cetera, from that account. What most people do is they start doing that. Well, now they’re working for themselves. Their customers pay them. They take that money, and they get paid, and they put it in their checking account. But the difference is now when you need supplies or when you have business expenses, you must account for those as well.

What a lot of people do is they’ll just go out and they’ll buy something, they’ll buy a tool, they’ll buy materials, they’ll buy supplies, they’ll buy a website, whatever it is they need to do, and they’ll just use their own personal checking account. Now you have money coming and going both for the business on the self-employed perspective, but also on the personal side, the home stuff, the household stuff as well.

Two Money Problems…

And very quickly, generally within a year or less, they’ll start to run into some problems and there’s really two problems that it’ll bring to fruition. One is taxes. And number two is the cashflow for both the business and the home. And that’s where we’re going to address.

Let’s address the second issue of cashflow first. When you’re running both your business and your personal expenses, and it’s all coming out of one checking account, things are going to be tough, because essentially, you’re buying groceries and paying the light bill, and you’re also buying supplies and tools, materials for the business.

And it’s going to get confusing, if not frustrating, because what’s going to happen normally is one person, generally your spouse will run the personal stuff and you’re trying to run the business stuff. So, you’re going to go to a job and you’re going to need supplies, but your spouse is going to need money for groceries and you’re going to have this friction and this tension going on in the home.

Envision it like having two hungry dogs and one bowl of dog food. They’re going to basically be fighting over what they can get. And at the end of the day, neither one is going to be satisfied. So, this framework that I’m going to present to you today will help eliminate all aspects of that frustration.

The other issue is taxes. When most people start out being self-employed, or a business owner, they’re not aware of the tax implications. When you worked for an employer, basically the money that you got had already been withheld for federal taxes, social security and Medicare have already been taken out of the employer takes care of that.

Well, when you become self-employed, you are the employer, you’re the employee and the employer. So, there’s no one else. to withhold for your behalf. So, you must do it. Most of the time that’s done for a sole provider or someone who starts an LLC, a limited liability corporation. They’re going to do that on their schedule C on their 1040.

So basically, the year goes by and then you do your taxes in February, March, or April. And that’s when you realize. That you have a big tax bill. And if you don’t withhold enough throughout the year, not only do you have that big tax bill, but the IRS will penalize you for not withholding enough throughout the year.

That makes a big deal when you have a large tax bill that you must pay, because again, you must pay not only. The federal income tax on the wages that you’ve earned through the business, through the services or products you sold. But you also now must pay social security and you get the privilege of paying both sides, the employee, and the employer, and you get to pay your Medicare withholdings, again, both sides, the employee, and the employer. Your tax bill is going to be larger because when you worked for an employer, you just played the employee side of social security, Medicare. And maybe unbeknownst to you, the employer paid the other 6. 2 percent for social security and the other 1. 45 percent for Medicare. Well, now you get the privilege of paying both, which totals up to be 15. 3 percent for payroll taxes.

You have then your income tax, 10%, 12%, 22 percent brackets on top of that. So, there’s a large tax impact to starting your business.

What I want to provide to you today is a framework that again, will help eliminate the frustration on the cashflow side, as well as help you prepare for and plan for that inevitable tax bill that’s coming. I Want to walk through that framework. I’ll show you here first what it looks like, and then we’ll unpack it. Bit by bit.

Two Separate Accounts

So again, here’s the financial framework that we will unpack little by little, step by step. So, the first thing we want to do is we want to have two accounts. We don’t want to just have one personal checking. We want to have a business checking account and a personal checking account. Thereby, delineating the money for each pot.

We don’t have to have two dogs eating one bowl. We want to have two bowls, one for each dog. Now, when you make. a sale or you get paid from a customer or money’s coming in from whatever source it is. All money, all business money goes into the business checking account. You do not put business checking money into the personal account, nor do you put other income, personal income into the business checking account.

The only thing that comes into the business checking account is all the business revenue from sales, invoices paid, et cetera, et cetera. Conversely if you need to buy something, supplies, tools, tech, web, whatever it is, all business expenses come out of the business checking account.

Again, we’re no longer commingling the money. So, you don’t use personal money. to buy the business expenses, use the money that’s in the business to facilitate it. So that inherently means there must be money left in that account. So, when you get paid, you can’t bring home every dollar that’s in there to the personal side.

To pay your bills, you must leave some in the checking account to buy supplies, tools, et cetera, to do the job, to then bring in more revenue.

Paying Yourself

Now, what is left in that account is profit on a profit loss revenue in minus expenses out is profit. So, the money that’s left in there is inherently profit. So, from the profits, the business, the employer. Which is you will now pay the employee, which is also you. But again, we’ve delineated it into two separate accounts. So, when it comes time to paying yourself again, you can’t bring all of it home.

You need to leave some in the business account for future expenses. But even of that amount that you are going to pay yourself, you can’t pay yourself all of it. Good rule of thumb to get started is to pay yourself about 75 percent of the money. So, for example, let’s say you want to make a payment to yourself.

You want to pay yourself a thousand dollars. Well, you can’t bring all thousand dollars home. You can bring $750 home to your account. So, you either write a check if you want to do it that way, online payroll, if you’re using some sort of system or transferring your bank account from one bank to the other.

So, the question is then what happens to the other 25%? Great question. What I recommend clients do is put it in the business savings account. This is money for taxes. Now, I put 75 / 25. It might not be that ratio for you. It might be more depending on your tax bracket, but at minimum, it’s going to be about 25%.

And the reason why, because again, you’re paying 15. 3 percent to payroll taxes, social security, Medicare. So, we’re there. If you’re getting over the standard deduction, $27, 000, whatever it is, moderate filing jointly. $13k on a single you’re in a 10 percent tax bracket. So, 15 and 10 is 25. So good rule of thumb is transfer into that savings account 25%.

Again, yours could be different. Recommend you get some tax advice and some planning to help you with your actual numbers. Again, this is a notional example. Now that business money that is in there, that’s going to get sent off to the IRS. Four times a year, you’re going to have to do quarterly payments.

I’ll show you that form that you use there in a minute. The money that then comes home to your checking account, that is used for your household budgeting. You pay your electricity bill, you buy your groceries, pay your mortgage, pay your rent, etc., etc. Car repair, gasoline, things like that.

Those are personal expenses. Now going back to that scenario of friction where you’re working about worry about cashflow, where you have one person, maybe the spouse concerned about the personal stuff and you’re concerned about business stuff, you can delineate roles and responsibilities, and each has their own pot to manage too accordingly.

Making Taxes Easy(er)

So, this is a way. that will help eliminate the concern with cashflow. And you have the money that’s going into the savings account for taxes. So ideally every quarter you would then get the tax form. So, 10 40 estimated tax form you would. Print out this form or you can do it online if you prefer, but each quarter There’s a voucher on here that you would use so quarter one voucher is due April 18th from last year 2023 so the idea being the money you made in January February March is In that savings account you transfer all that savings account money back to the checking and you pay your quarterly taxes The second estimate payment is due in June.

So, the money makes in April May and those two months, this is weird. I don’t know why the IRS says that, but they do a quarter of two and a quarter of four. I don’t know. Don’t ask me. I’m sure there’s a reason for it. But the second quarter is only two months. You take your money again. That’s from April and May. It’s in savings account. Transfer it back. Pay it to your taxes.

Again, next one’s due in September, September 15th. You have the money in savings. You put the money in there in June, July, and August, you transfer it back and then you pay your quarterly taxes.

And the last one is due four months later, which is January 16th for 2024. Again, this is for 2023 tax year. The money from September, October, November, and December four months in that quarter two and four, I don’t know why that’s how they do it. You basically move back the money from savings and the checking, and this will ensure that you always have the money for your taxes.

Now, the only thing you might have to tweak again is that percentage. So, this helps eliminate both aspects. Of cashflow and taxes, because the money is in that account there that you can just transfer it back into the checking and pay your taxes solves both problems.

So, I hope you understand how the framework works in that now you’re dividing your business and your personal, you’re keeping things separate, and you have the money for quarterly taxes being set aside each month that you pay yourself. But the second critical aspect that you must manage as a self-employed business owner is that of tracking your income and your expenses for taxes.

Accounting For Expenses

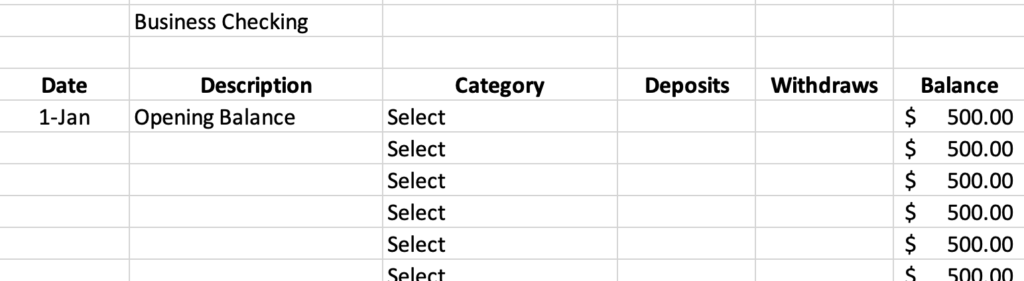

There are several ways to do that. One of the simplest ways to do that is on a spreadsheet. So, I’ll show you here a notional example of a spreadsheet that I provide business owner clients that they can use that will help them keep track of things throughout the year. Additionally, help me Do their taxes because I do their tax preparation and filing for them as part of their planning service in March and April.

So, this helps them throughout the year and helps me as I prepare their taxes.

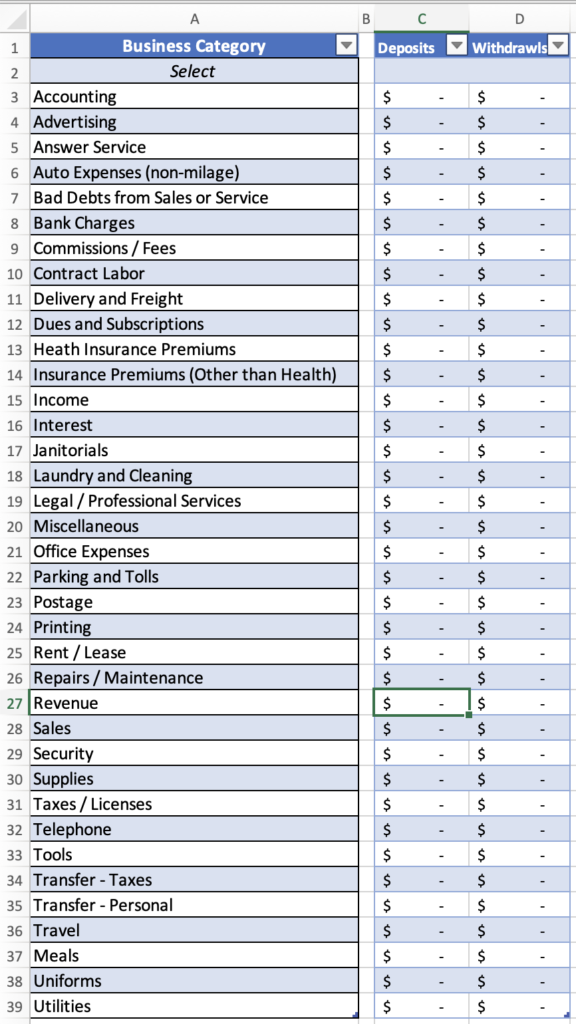

So here again is an example of a spreadsheet that you can make to help you with your accounting throughout the year if you’re not using something like QuickBooks or FreshBooks or something like that. So, this here is a simple journal entry replication just in a spreadsheet.

So, you can use a spreadsheet like the one I provide clients. Or you can use other software and applications. One of the most predominant ones in this space is QuickBooks by Intuit. It has both a desktop and a cloud-based versions means you can do it Mobily if you want and at the base level, it essentially does what that spreadsheet does.

It’s just a logging of transactions and accounting journals, and it’ll look very much like that spreadsheet. But those applications and that software has other built-in utilities, such as invoicing. So, you can use it to invoice clients and customers. You can receive payments through some of them, obviously for an additional fee, but it’s there again.

The reporting aspect is very helpful for you can do a job cost accounting to see how profitable you are on a job. If you want, you can look at it and you should at least on the monthly level of. how much you made. We call that a profit and loss statement. You can also get balance sheet statements, which is basically assets and liabilities for the business to see how much it’s worth or its capitalization.

Personally, I’ve used QuickBooks for Macs for many, many years. I have liked that I’ve used it for, for a handful of years for different. Businesses along the way. My wife and daughter have a bookkeeping business called true wealth tax that they to use QuickBooks accountant online.

It’s a cloud-based version where they can interact with their bookkeeping clients to keep track of things. So, they can see it on this side and the clients can see it on that side as well.

A couple other notable. Accountant software applications is that of fresh books, fresh books. Wave is a popular one. Zoho books and sage 50 accounting.

Below is a link to a recent PC magazine. Best accounting software for small businesses in 2023 article that you can look and explore through.

https://uk.pcmag.com/old-accounting-tax/32761/the-best-small-business-accounting-software-for-2020But hopefully this will help you eliminate some of those cashflow and tax needs. Hopefully it now gives you a framework of how to potentially restructure your money and it’ll make your business accounting and your business expenses very smooth, very systematic, and very much in control.

So, I hope this helps you on your financial journey.

If you want copies of that framework, you can go to truewealth.show/resources page and click the money management framework for business PDF, and you can have a copy of that.

If you have any questions, you can leave them in the comments below or send me an email at Mike at true wealth dot show Mike at true wealth dot show.

And until next time, I hope you have a great day.